Exploring the Exciting Globe of On the internet Slots: A Guidebook for New Gamers

Overseas Trade (FX) margin investing is a popular strategy for traders to be involved in the worldwide forex markets with Improved buying power. This investing method enables investors to manage huge positions with a relatively small number of cash. Although Forex margin trading provides the prospective for substantial earnings, Additionally, it carries sizeable hazards. This article will tutorial you throughout the basics of Forex margin trading, how it really works, and what you might want to take into account before diving in.

Precisely what is Forex Margin Investing?

FX margin trading includes borrowing revenue from a broker to trade currency pairs while in the overseas Trade market. The "margin" refers to the level of funds you might want to deposit Using the broker to open a leveraged placement. Leverage means that you can Command a much bigger position than your initial expenditure, most likely expanding your profits—or losses.

How Does FX Margin Trading Function?

Opening a Margin Account: To begin FX margin trading, you need to open up a margin account which has a forex broker. This account will let you borrow money to trade currency pairs.

Leverage in Forex Investing: Leverage is usually a vital part of Forex margin investing. It’s commonly expressed being a ratio, including 50:one or one hundred:1, which suggests the amount of you'll be able to trade relative for your margin. For instance, with a hundred:1 leverage, a $1,000 deposit allows you to control $one hundred,000 well worth of currency.

Margin Need: The margin necessity is the sum of money you need to deposit to open a position. This necessity may differ by broker along with the forex pair becoming traded. Commonly, brokers require a margin starting from one% to 5% of the trade’s total price.

Calculating Margin: The margin expected for a trade is calculated according to the size with the position as well as leverage made available from the broker. Such as, for those who’re buying and selling a $100,000 place with fifty:one leverage, the necessary margin could be $two,000.

Interest on Borrowed Funds: In Forex margin buying and selling, the curiosity you fork out on borrowed resources is usually reflected in the expense of Keeping positions overnight, referred to as the "rollover" or "swap" amount. These charges can either certainly be a credit rating or debit, depending on the forex pair and current market conditions.

Margin Phone calls and Liquidation: If the market moves against your place and also your equity falls beneath the expected margin amount, it's possible you'll receive a margin contact. This needs you to deposit extra funds or near some positions to stay away from liquidation because of the broker.

Advantages of FX Margin Trading

Amplified Current market Publicity: Leverage means that you can Command a considerable place with a small number of cash, growing your potential returns.

Diversification: Margin investing lets you diversify your trades throughout diverse currency pairs, enhancing your potential to cash in on different industry movements.

Revenue in Bull and Bear Markets: Forex margin trading lets you reap the benefits of both equally increasing and falling markets by likely long or quick on forex pairs.

Accessibility: The Forex sector is open 24 hrs each day, 5 times every week, supplying traders ample alternatives to engage in the worldwide currency markets.

Threats of FX Margin Buying and selling

High Chance of Decline: The identical leverage that can amplify your earnings might also Amplify your losses, perhaps wiping out your full expenditure.

Margin Phone calls: If the market moves from you, you might be needed to deposit further resources immediately to keep up your positions, that may be tense and costly.

Curiosity Charges: Holding leveraged positions overnight can incur rollover expenditures, which may incorporate up over time and erode your income.

Market Volatility: The FX sector is very unstable, and unexpected price actions can lead to sizeable losses, especially when buying and selling on margin.

Is Forex Margin Investing Good for you?

Forex margin buying and selling is ideal suited for skilled traders who may have a sound knowledge of the forex marketplace, threat administration, and the use of leverage. If you’re a rookie, it’s important to start with a demo account or a little number of cash and little by little improve your publicity while you acquire confidence and experience.

Summary

Forex margin trading gives an enjoyable chance to engage in the worldwide currency marketplaces with enhanced purchasing ability. Even so, it’s vital that you approach it with caution, as the challenges involved might be substantial. In advance of engaging in FX margin investing, ensure you have an intensive idea of how it works, the pitfalls involved, along with the strategies which can help you take care of These pitfalls. Proper training, self-control, and risk management are crucial to starting to be An effective Forex margin trader.

By carefully taking into consideration these components, you can make informed choices and most likely make the most of the dynamic and fast-paced planet of forex buying and selling.

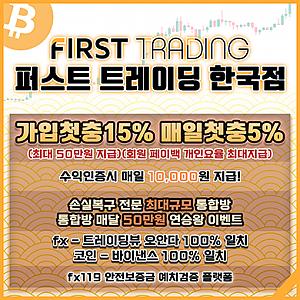

Get more info. here: 마진거래